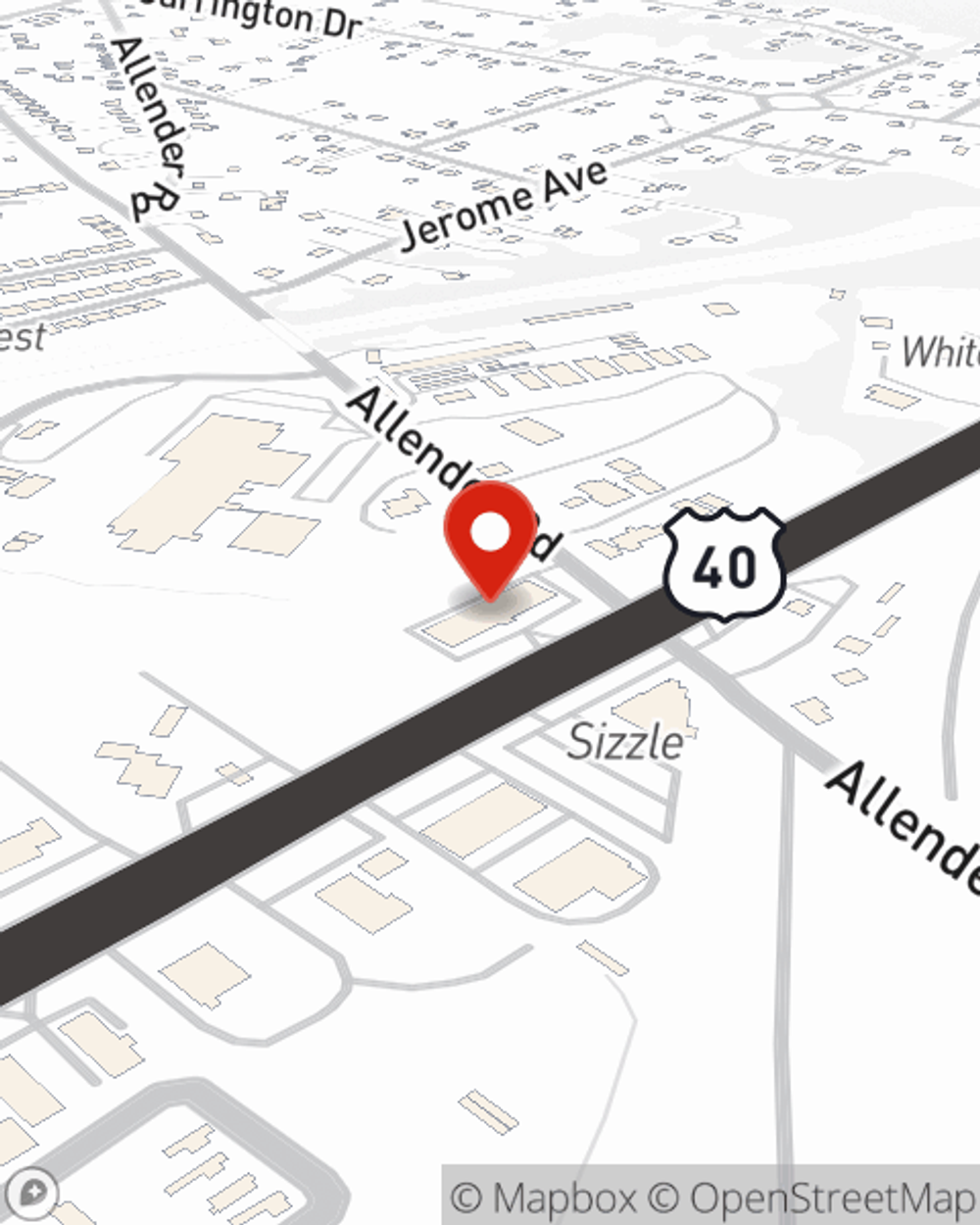

Business Insurance in and around White Marsh

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

- White Marsh

- Baltimore

- Nottingham

- Middle River

- Joppa

- Rosedale

- Essex

- Perry Hall

- Gunpowder

- Bradshaw

- Upper Falls

- Joppatowne

- Chase

- Bowleys Quarters

- Middlesex

- Rossville

- Edgewood

- Parkville

- Overlea

- Carney

- Abingdon

- Fork

- Glen Arm

Help Prepare Your Business For The Unexpected.

It takes courage to start your own business, and it also takes courage to admit when you might need support. State Farm is here to help with your business insurance needs. With options like worker's compensation for your employees, extra liability coverage and errors and omissions liability, you can feel confident that your small business is properly protected.

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

Keep Your Business Secure

Whether you own cosmetic store, a HVAC company or an ice cream shop, State Farm is here to help. Aside from outstanding service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Call Dean Sprague today, and let's get down to business.

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Dean Sprague

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.